A flexible budget provides a more accurate reflection of costs and performance at different levels of activity compared to a static budget. A budget estimates how much money you expect to make and how much money why is prepaid insurance a short term asset you plan to spend. Often businesses use accounting software to take the guesswork out of budgeting. You can view the actual income and spending in previous years for the corresponding season or month.

Ask Any Financial Question

They just know they’ll want to be saving enough for retirement. It’ll help you figure out how much you can afford to contribute on a regular basis to a 401k or an IRA at any stage of your financial life, and then it’ll help you keep making those contributions. Regularly saving and investing a portion https://www.accountingcoaching.online/au-section-722-interim-financial-information/ of your income can help you achieve your financial goals and create a safety net for emergencies. Developing a clear understanding of your financial goals and incorporating them into your budget will allow you to strike a balance between fulfilling your desires and securing your financial future.

How much will you need each month during retirement?

Budgeting is the process of creating a plan to spend your money. Creating this spending plan allows you to determine in advance whether you will have enough money to do the things you need to do or would like to do. Daphne Foreman is a former Banking and Personal Finance Analyst for Forbes Advisor. She has worked as a personal finance editor, writer, and content strategist covering banking, credit cards, insurance and investing.

You’re our first priority.Every time.

Let’s say that you and your partner live in New York City in a small one-bedroom apartment and things are going fine for both of you until your family dynamic changes. For instance, you may have a child or an in-law who comes to stay with you indefinitely. This may mean you’ll need (and want) more room to accommodate the new addition.

- All persons in the enterprise must have full involvement in the preparation and execution of budgets, otherwise, budgeting will not be effective.

- 11 Financial is a registered investment adviser located in Lufkin, Texas.

- Some people prefer to write their budget out by hand, while others use a spreadsheet or budgeting app.

- That’s especially true if you’re budgeting manually, with pencil and paper.

Janine might realize that she never remembers to pack lunch, so she and Henry begin to pack a week’s worth of lunches every Sunday. Or she may realize that she brings her lunch, but it’s never as appealing as hot food. In that case, she decides to stop carrying cash to work to ensure that she eats what she brought. For example, Janine has been spending $10 every day on lunch at her workplace cafeteria. She and Henry have a weekly budget of $50 for dining out, but Janine’s cafeteria spending means she blows through that budget at work rather than on evenings or weekends.

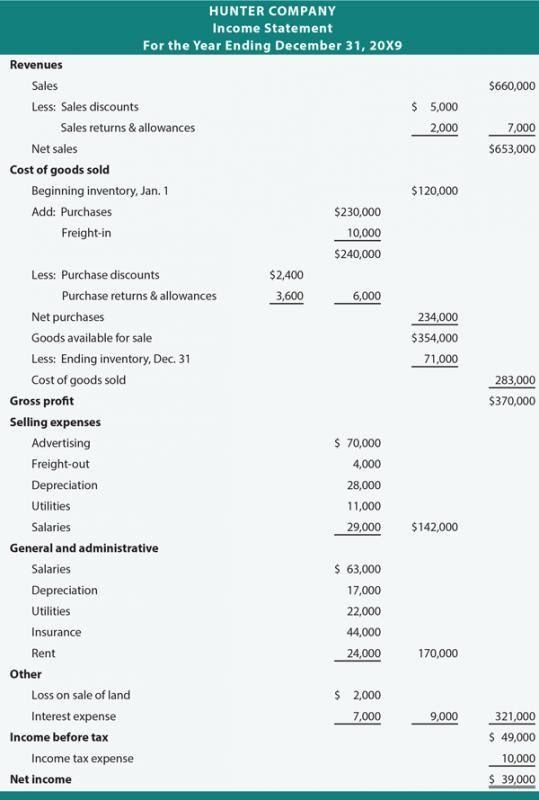

How Budgeting Works for Companies

The operating budget is composed of two parts a program or activity budget and a responsibility budget. These represent two different ways of looking at the operations of the enterprise, but https://www.simple-accounting.org/ arriving at the same results. You get more organized by sitting and thinking out, and planning your expenditure. To save money, you start planning expenses and selecting vendors carefully.

Swiping a debit card, on the other hand, may not feel nearly as real. What it does mean is that you can maintain control over where your money goes and enjoy greater financial confidence and success. There are many ways to go about budgeting, and you may need to try a few before you find the right fit. You can also speak to a financial advisor for help choosing the best budgeting route for your household. You can also create an expense tracking spreadsheet in Excel, ask for receipts for every purchase, and total them up at the end of each week or month. Budgeting can involve making a comprehensive list of expenditures or focusing on a few categories.

On the downside, it may create stress if you leave yourself with too little to cover your monthly costs. “Building a budget doesn’t have to be overly complicated or time-consuming,” says Brittany Castro, former in-house CFP for Mint. “It’s actually the first step in putting yourself in control of your finances because it means you know where your money goes each month.”

They can help you create a budget that fits your financial situation and goals, making the process less overwhelming. If you have a complex financial situation, you might find it useful to talk with a professional. ” you’ll likely come across many different definitions based on popular budgeting strategies. There’s no one right way to budget; the method that works for you depends on your preferences and financial situation. Learning about three of the most common approaches can help you start creating a budget that works for you. Budgetary control does not merely involve the matching of estimated expenses to actual expenses.

Before my wife and I started budgeting, we spent money like it wasn’t a big issue. From going out to eat, to taking trips to the mountains, without a budget it was hard to correlate our daily spending to our less than optimal financial situation. I mean, sure, buying one lunch out to eat at a time doesn’t feel like a big deal in the moment. However, when you sit down with a budget and add up the cost of 30 Chipotle burritos each month (yeah, I said 30), those seemingly insignificant lunch bills add up to way too much spending.

It encourages communication of individual goals, plans, and initiatives, which all roll up together to support the growth of the business. It also ensures appropriate individuals are made accountable for implementing the budget. The biggest challenge, however, is that some improvements might happen in a shorter period than the budget allocates. A budget can provide insights into the money coming into a business and also going out.

Budgeting will be ineffective and expensive if it is unnecessarily detailed and complicated. A budget should be precise in format and simple to understand; it should be flexible, not rigid in application. To get the best results managing, management should use budgeting with intelligence and foresight, along with other managerial techniques.

It allows you to make financial decisions ahead of time, which makes it easier to cover all your expenses along with paying off debt, saving for the future, and being able to afford fun expenses. Budgeting consistently can help you turn your finances around and start the process of building wealth. There are many reasons to have a budget, depending on the individual.