I still do a shocking amount of bookkeeping, invoicing, and other financial tasks for my business with manual spreadsheets and processes. But I’m a solopreneur/freelancer, and so my business finances are easy to manage. If you have a solo business like me, it might feel “good enough” (for now) to manually track your own numbers and make your own spreadsheets to share with your accountant at tax time. You may need only account reconciliation services now but will need to layer on financial and cash flow management services later. If a firm only offers a package that includes services you don’t need, you may pay more than you should at this stage in your business. Cash basis accounting records transactions only when cash changes hands.

Small Business Accounting Software

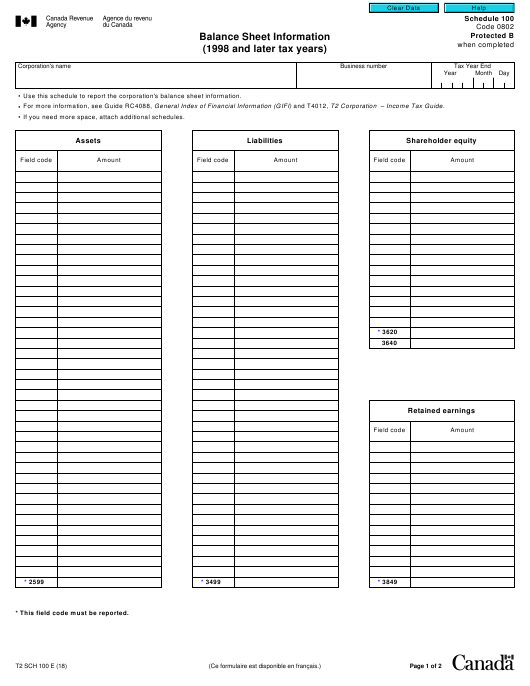

Tax professionals include CPAs, attorneys, accountants, brokers, financial planners and more. Their primary job is to help clients with their taxes so they can avoid paying too much or too little in federal income or state income taxes. When you start a new business, you need to set up a chart of accounts to journal transactions in any of the five categories including assets, liabilities, expenses, revenue and equity. This chart of accounts is used to gather statements, analyze progress, and locate transactions. It recognizes revenues when cash is received, and expenses when they are paid. This method does not recognize accounts receivable or accounts payable.

- The majority of your financial transactions will have to do with income and expenses.

- That’s because the single-entry bookkeeping is a lot more simple and straightforward than the double-entry one.

- Examples of assets include real estate, inventory, cash, and accounts receivable.

- For example, I can easily add a project by filling out a simple form, then access the project’s financial reporting and cost/income tracking from the left-hand “projects” menu tab.

- However, they complain that it is not as easy to use on a Mac computer and the interface looks dated on these devices.

Best Accounting Software for Small Businesses

Tech-savvy business owners or those familiar with accounting principles typically use accounting software. Digital bookkeeping offers a much quicker method than manual calculations. Unlike some competitors that require you to pay extra for a time-tracking module, all FreshBooks plans come with unlimited time tracking.

Financial Statements for Small Businesses

Each of these records should be kept for a specific length of time—some for 10 years, some for as few as three. You can learn more about record retention periods in our guide to small business recordkeeping. You should also keep any other documentary evidence that supports an item of income, a deduction, or credit shown on your tax return. Whether you’re good with numbers and spreadsheets or not, every small business owner needs to understand the basic role that bookkeeping plays in their business.

Best Accounting Software For Small Business Of 2024

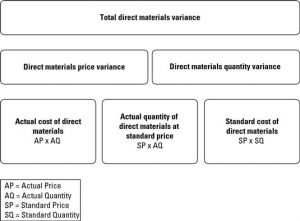

Gross margin is the difference between the selling price of your product or service and the cost of goods sold. To calculate gross margin, divide the selling price by the cost of goods sold. For example, if you sell a product for $100 and it costs $50 to produce it, your what’s the difference between revenue and profit the motley fool gross margin would be 50 percent. An accountant may be able to advise you on which legal structure is best for your business, depending on its size, complexity, number of founders, and other factors. A journal entry is a financial transaction entry in the general ledger.

There are substantial differences in the skills and costs of accountants and bookkeepers. While a bookkeeper is focussed on day-to-day transactions, the accountant concentrates on the strategic financial operations. If you’re planning to outsource your accounting activities, choose someone who is the best match for your business. To separate your business’s finances from your personal money, open a separate bank account for your business. This helps you file income taxes accurately as you can deduct business expenses on your tax return.

To prepare the system for the next accounting, temporary accounts that are measure periodically, including the income, expense and withdrawal accounts, are closed. The balance sheet accounts also called the permanent accounts, remain open for the next accounting cycle. Once the adjusting entries are made, an adjusted trial balance must be prepared. This is done to test if the debits match the credits after the adjusting entries are made. This is the final step before the preparation of the business’ financial statements.

Head over to our piece on the best payroll software for small businesses. Here are five more small-business accounting software options that could work better for you. QuickBooks is easily one of the most popular financial, tax, and accounting software options in the world. However, Xero’s $13 a month plan https://www.simple-accounting.org/accrual-accounting-vs-cash-basis-accounting-what-s/ limits you to entering only five bills and sending only 20 invoices a month. You can send unlimited invoices and quotes with only the Growing and Established plans, which start at $37 and $70 a month, respectively. In contrast, both QuickBooks and FreshBooks offer small-business expense tracking up front.

However, they say the platform could use more automations and more in-depth reporting. They also wish they did not have to pay extra for features such as adding team members, saving credit card information or processing payroll. Open a business bank account and business credit card and run all your business’s income and expenses through those accounts rather than your personal checking account or credit card. A separate bank account makes it much easier to have a clean record of business transactions. In addition, Pilot performs automatic transaction imports, monthly account reconciliations, and cash forecasting.

At the very least, you’ll want to sit down for bookkeeping monthly, but we strongly recommend you update your books at least weekly, though preferably daily. Once you’ve settled on an accounting method, it’s time to set up your books. Here are the main questions to ask that can guide you toward creating the best bookkeeping records for your small business. If you set up your finances with accrual-basis accounting, you’ll record financial transactions when they occur, not when the money moves accounts.

To begin, I filled out a simple form with my name, contact information, company name, industry and a chosen platform. I was then taken through a two-step process to verify my identity using my email and mobile phone. I could star my favorite reports to add to my “favorite reports” list at the top of the page. When I clicked on a report, it was already populated with all my relevant data points. I only had to click the “send” button at the top of the page and specify an email recipient to share the report. Next, I clicked on the “Projects” menu item from the left-hand menu.

With its straightforward accounting software, QuickBooks is an easy favorite amongst freelancers, and not just because many of them bundle it when filing their own taxes with TurboTax. An accounting firm is fully staffed with experts to offer bookkeeping and accounting https://www.intuit-payroll.org/ services for your business. It prepares financial records to help you track your revenues and expenses. Accounting firms help you with your long-range planning with cash flow projections and advice on how to allocate your capital for an additional cost.

All you have to do is integrate your bank and payment providers with Deskera. If you want to accept online or credit card payments, you can use either Stripe or Paypal. Stripe allows you to directly integrate any application for tracking invoices, expenses, and more. Consider what you need the accounting software to accomplish for you and your business, and seek out software that will help you accomplish these tasks with ease. For example, do you need invoicing and billing support, or do you also need tax compliance and robust reporting?

Read this guide to discover financial reporting and the different accounting systems, accounting software, and whether you can do your own small business accounting. Both the Growing and Established plans offer unlimited invoices and bills. The only difference between the two is that the Established plan has additional features like multi-currency, expense management, and project costing. For example, a company has to reference specific time periods in reports and follow the same accounting method across time periods to ensure accurate comparisons. Though small businesses aren’t required to follow the same rules, doing so can help ensure a higher level of consistency.

Consider the Online Masters of Accounting (iMSA) offered by the University of Illinois Urbana-Champaign. A master’s degree in accounting will help you satisfy the semester credit hours required to become a licensed CPA. Taking online courses can be a great way to learn the basics of accounting for your business. Whereas you might only periodically consult your accountant, a bookkeeper touches base more frequently and handles daily accounting tasks. Regardless of who you hire, knowing basic accounting principles can help you understand your business better and have more productive conversations with your financial team.